-

Welcome to our website

Reliable And Affordable Products For Your Home and Office.

- +91 9825135768

+91 6352220425 -

Reliable And Affordable Products For Your Home and Office.

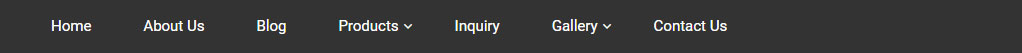

We at WiseMonk Investment, Understand that every investor is unique, and our goal is to tailor our services to meet your specific needs and objectives. Whether you are seeking long-term growth, wealth preservation, or a combination of both, our team of experienced professionals are here to guide you every step of the way.

Get customized advice across investments, goals, expenses, insurance, loans, and taxes.

Implement your customized advice by buying all the recommended financial products on one single platform

Track your journey and review/rebalance your investments to make sure they are aligned with your goals.

Retirement is one of the most important life events that many of us will ever experience. This is that stage in which we only have cash outflows.

Create a legacy that provides supports the causes and charities you care about, and maintains your values across future generations

Goal Based Planning is the first step in successful goal achievement. It’s when you switch from a passive state to being involved in life.

Mutual fund is essentially is a Trust. Mutual Fund is a link between the capital market and the Investors.

Life Insurance planning is a critical component of a financial plan that includes evaluating risks.

It covers expense of hospitalization due to illness or accident. that can protect your family from financial hardship.

+91 9825135768

+91 6352220425

WiseMonk Investment © 2022|